Intro: Decision Making

We just wrapped up our planning for Q2 2023, with all the pressures of quarterly planning to exhaust all options and watch for all risks.

Knowing the value of fast decision-making, I wanted to share a lesson learned in Q1. The lesson is that when you’re cornered with rare events, crises, and waiting for miracles, just make a decision. Or even remake a previous decision if you have to instead of “optimizing the next decision.”

Because even remaking the decision can often be a better decision, giving you more information about that specific problem. If you’re genuinely trying to learn, you’ll eventually reach the point, “Hey, this way isn’t promising enough because I tried it for two months.”

Another reason that showed us “optimizing the decision” mindset could be damaging is that it puts the decision itself in focus, but who cares about that? You don’t necessarily need to be that good at decision-making if you get good at remaking the decision when necessary.

A dear person once told me about a concept in aviation called “finding a landing” when you land a plane (Her sister is a pilot.)

When you find a landing, you’re always off track, constantly doing coarse correction, and at that moment, if the decision becomes the focus, like “How to make sure you’ve taken the precisely best decision?” It doesn’t seem productive and would be pretty frustrating. Instead, it’s about constant feedback and learning and coarse correction. Even though many decisions might look like a painkiller or seem too ambitious, they may not necessarily be too low or too high.

A book I highly recommend about this is “The Inner Game of Tennis by Timothy Gallwey.” One of the general lessons of the book is that a big factor of success is about being good at seeing what is happening at the moment and training your conscious and feelings to make the corrections. This approach always helped me in hard times and deeply resonated with me. Now I know why I always get lucky! :)

Q1 2023

Launching in January in Berlin, Q1 2023 was an initial milestone for Eveince with objectives regarding regulatory, fundraising, and traction. But before going forward, I wanted to thank Berlin Partners, that helped us a lot with materials for our market research, establishing our company, getting visas, and anything related to getting settled in Germany.

Regulation

After many talks and discussions with many law firms in 2022, we finally got on the right track with guidance from the PXR and Rain team; we also must admit that BaFin is one of the most amazing regulatory frameworks we have seen, being comprehensive, technical, and clear.

For those of you who don’t know Eveince architecture, our infrastructure has its own fund administration and accounting system. Besides reducing the costs of account management for our clients, it also amazingly helped us with conforming with BaFin's definition of a “Platform for signalling and automated order execution.”

Traction

Resolving the challenges of regulation allowed us to welcome our first institutional investor onboard. Doubling our AUM in Berlin was the result but definitely not the end of it. We also started an amazing partnership with the Quantbase team (which got into the YC winter batch 2023), and using their platform, we got connected to a client base with 8x of our current AUM organically.

Besides the AUM, the number of users grew 4x compared to Q4 2022, which was not only due to launch and regulation but also being now able to sign up right from our website. The same growth goes for the subscriptions coming from Quantbase; with two 4x on user growth, we got another 8x.

Performance

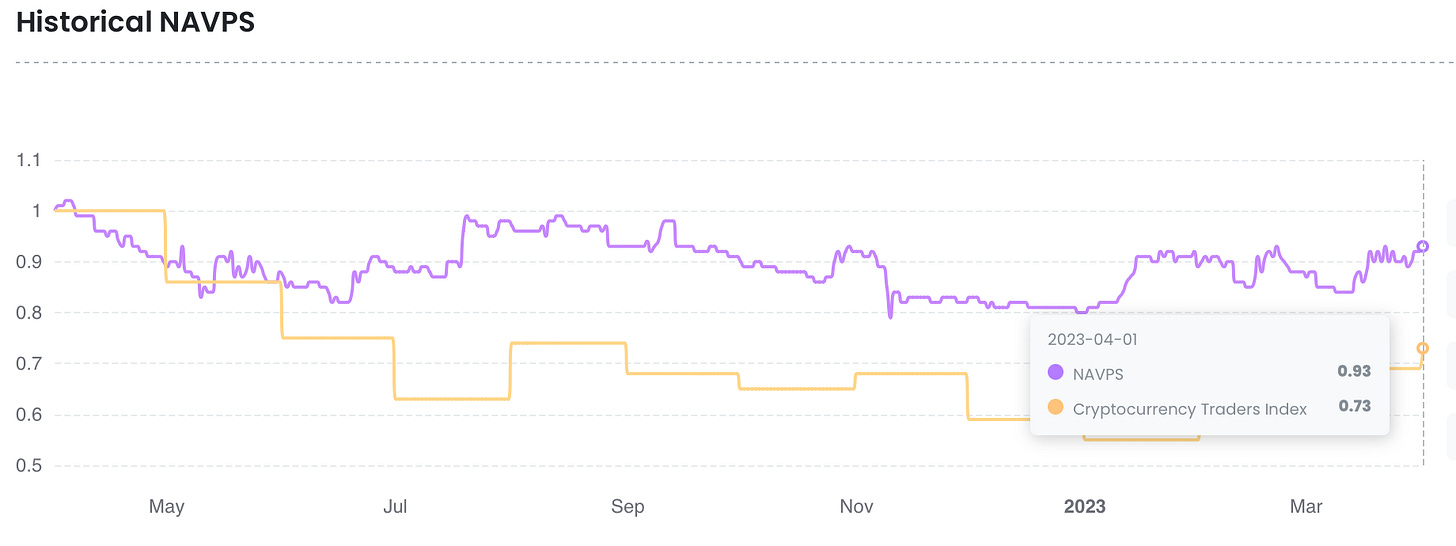

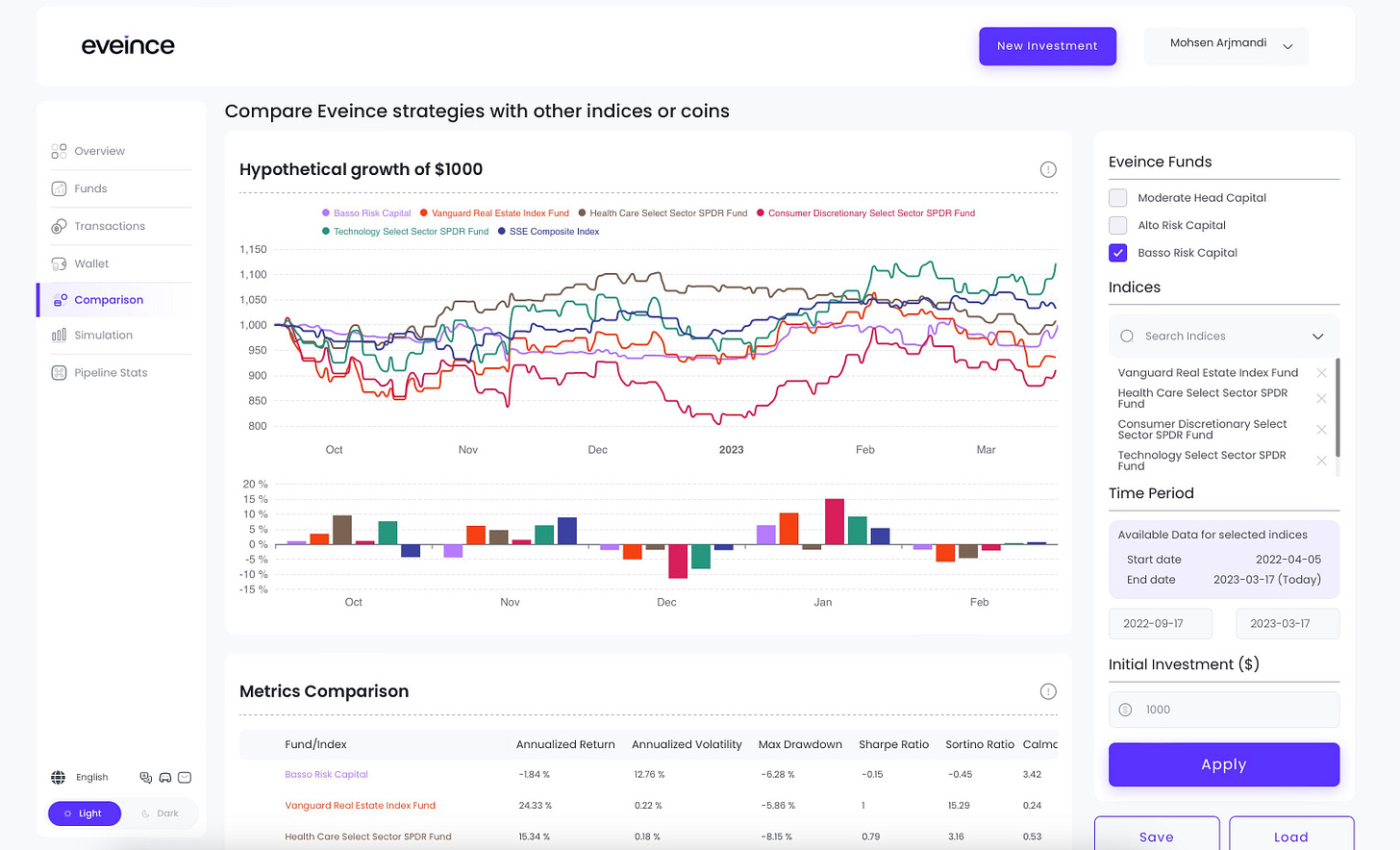

Besides our growth in AUM, user signups, and subscription, the total traded volume has passed $18M since our trading launch. (We haven’t included our on-off period in 2021, which will increase this to more than $25M).

Basso (Low risk) return Q1 2023: 9%

Moderate (Medium risk) return Q1 2023: 14.3%

Alto (High risk) return Q1 2023: 15.9%

Avant-garde (Bitcoin holder) return Q1 2023: -7.4

Note: The negative performance of Avant-garde in this quarter was mainly due to the change in Bitcoin behavior. Our bet is that it gets corrected in this quarter. And the overall performance is also less than expected because it’s the youngest strategy in our portfolio, with less than a year in the forward test. After all we didn’t start this strategy only to evaluate it in eight months, so we’ll give it more time.

Tech

Our main focus in the tech team was to continue our R&D and maintain and support the current system. The main topics that we were busy with in Q1 were:

Portfolio-aware signaling in our direction models

A new design for our models that enables us to generate a set of orders from our direction models instead of loosely coupled integration with the portfolio rebalancing service. This new design mainly began to address integration challenges with other platforms like Quantbase.

Next generation of our order execution with higher explainability

With more explainable moving parts in our order execution engine, we were able to increase model robustness and also find better ways to address some of the known issues in model decisions. This new architecture is a new door to gaining better performance.

New APIs for our clients

We actually designed this in Q4 2022. It’s a set of APIs that helps other funds and trading systems to get a reliable connection to Binance. We’re testing some alpha users in Q2 to iterate on the API shape.

Our investment app on the client side

Before getting the regulation, we were only able to connect to the client wallet, but since we are able to sign SMAs, having a well-designed app to provide reporting and support was needed more than ever.

Q2 2023

It has already started, and we’re on track! The goal in Q2 is for Eveince to bet more on low-risk cash-generating solutions.

Onabord, our first LP ( It was also evaluated to keep this item until the end of Q1 2024.)

Financial goals (in terms of revenue)

Start a new R&D on our direction models

New API deployments

Fine-grained product development for FinTechs

Generative models in quantitative finance

Wish us luck!