Introduction

In one of our previous blog posts, Risk Profiling, we elaborated on risk profiling in investment firms and explained the challenges in extracting insights from it. One of the biggest challenges was how to measure the investors’ total risk tolerance by some limited questions. This difficulty originated from the subjective nature of risk perception. Each investor has its own biases and thought processes when they want to respond to the questions, which impacts how they answer the questions. In this post, we will describe this challenge and explain a risk profiling framework that includes risk perception as a measurement unit.

As we mentioned in the last related blog post, risk profiling is a tool to measure the investors’ risk tolerance before an advisor provides a customized portfolio. Like many other tools, risk profiling also has numerous weaknesses in determining an accurate risk score. The most common way for risk profiling is through risk questionnaires, which are pervasively used at the moment, and also, there is a significant variance between their results. The variance leads to an inappropriate portfolio for individual investors, and because risk tolerance is often the sole determinant of asset allocation, the consequence of measurement error is profound. For example, it is possible that the same investor, on the same day, in the same frame of mind, could walk into one firm and be profiled one way and into another and be seen differently. As another example, the result could be different for the same person in the same firm but at a different time due to subjective psychological impacts.

This instability in the definition, approach, and measurement of risk tolerance among investment firms, creates a considerable concern over reliability and validity. Generally, risk assessment is a complex discipline that its practitioners do not fully understand. Thus, risk assessors must be aware of the strengths, weaknesses, and limitations due to the significant impacts of the results.

The main reason for this broad variance in the questionnaires’ outputs stemmed from the concept of subjective risk perception. This concept defines a new perspective on risk tolerance, which involves dynamic personal experience, perception, and definition of risk in the calculation. Before diving deep into this concept, it would be better to define risk and risk tolerance one more time.

Definition of Risk and Risk Tolerance

The complexity of risk tolerance begins with the definition, and any definition of risk tolerance must begin with a definition of risk. The risk applies to far more areas of concern than financial matters and has more distinct interpretations than one assumes at first glance. The best representative definition of risk that I have found is from Solvic (1992), who discusses risk and its objective and subjective nature.

“ One of the most important assumptions in our approach is that risk is inherently subjective. Risk does not exist out there independent of our minds and cultures, waiting to be measured. Human beings have invented the concept of risk to help them understand and cope with the dangers and uncertainties of life. There is no such thing as real risk or objective risk. The nuclear engineer’s probabilistic risk estimate for a reactor accident or the toxicologist’s quantitative estimate of a chemical’s carcinogenic risk are both based on theoretical models, whose structure is subjective and is laden by assumptions, and whose inputs are dependent on judgment. “

The concept of risk provides considerable complexity. Generally, in the financial world, risk refers to volatility as measured as standard deviation or variance. This use of the term risk is not judgmental and does not distinguish between gains and losses. Standard deviation and variance measure the distance from a mean in both the positive and negative directions. So to a financial expert, risk means volatility. The higher the risk, the higher the expected gains and the larger the potential losses. There is a big question here. Do the investors have the exact definition of risk as the financial experts have? In an interview by Evensky (2004), Nobel Laureate Daniel Kahneman answered this question, “Is there any research on what risk means to investors?” He replied, “Well, it certainly does not mean standard deviation. People mainly think of risk in terms of downside risk. They are concerned about the maximum they can lose. So that is what risk means.”

Although it is difficult to define the risk, the concept of tolerance provides an easier definition. Tolerance can be defined as the capacity to endure hardship or pain. In the financial market, risk tolerance implies enduring the hardship or pain of fluctuations in price while holding assets in hopes of gains in the long run. However, as Sovic discussed, these concepts are subjective and depend on different factors such as age, family status, job status, wealth, experience, financial knowledge, and many other attributes of each individual.

Subjective Risk Perception

Now, after we review the definition of risk tolerance and the subjective elements that affect it, we are ready to discuss subjective risk perception. By definition, subjective risk is the perceived chance of something, especially bad, based on a person’s opinion, emotions, gut feeling, or intuition. Actually, it is not a mathematical perspective of the situation but rather a quick assessment according to a feeling at the time. Hence, this type of risk differs from person to person due to its dependence on personal biases. Often, we can explain the subjective risk rationally, but predicting and measuring it cannot be made precisely.

As we showed before, risk tolerance evaluation is a multidisciplinary function. Now, we can demonstrate the factors that include the subjective risks, which are often arduous to measure in Fig. 1. The multidisciplinary risk tolerance evaluation factors are shown, and the factors illustrated by the yellow colour are those with subjective nature. Accurate risk profiles will never be achieved unless we can measure both risk perception and risk tolerance, so we must add subjective elements into our procedures.

Risky Asset Allocation Framework

Now, we know that subjective risk perception has a significant effect on risk profiling results and should be accurately considered before asset allocation. However, measuring this abstract element is challenging. Researchers are endeavouring to extract various variables that help us quantify risk perception. The early research has found decision-theory variables, but these variables alone cannot fully explain how individuals perceive financial risk. To enhance the measurement, the behavioural influences have been extracted as new variables by researchers from various studies. These variables have been divided into decision-theory and behavioural by Linh Nguyen et al. (2017). These variables are summarized below:

Decision-theory variables

Loss Outcome

Gain Outcome

Loss Probability

Volatility of Return

Behavioural variables

Worry

Catastrophic Risk

Control

Known / Familiarity

Trust

Understanding

The seriousness of the consequence

Regulation

Attention

Performance Predictability

Prevalence

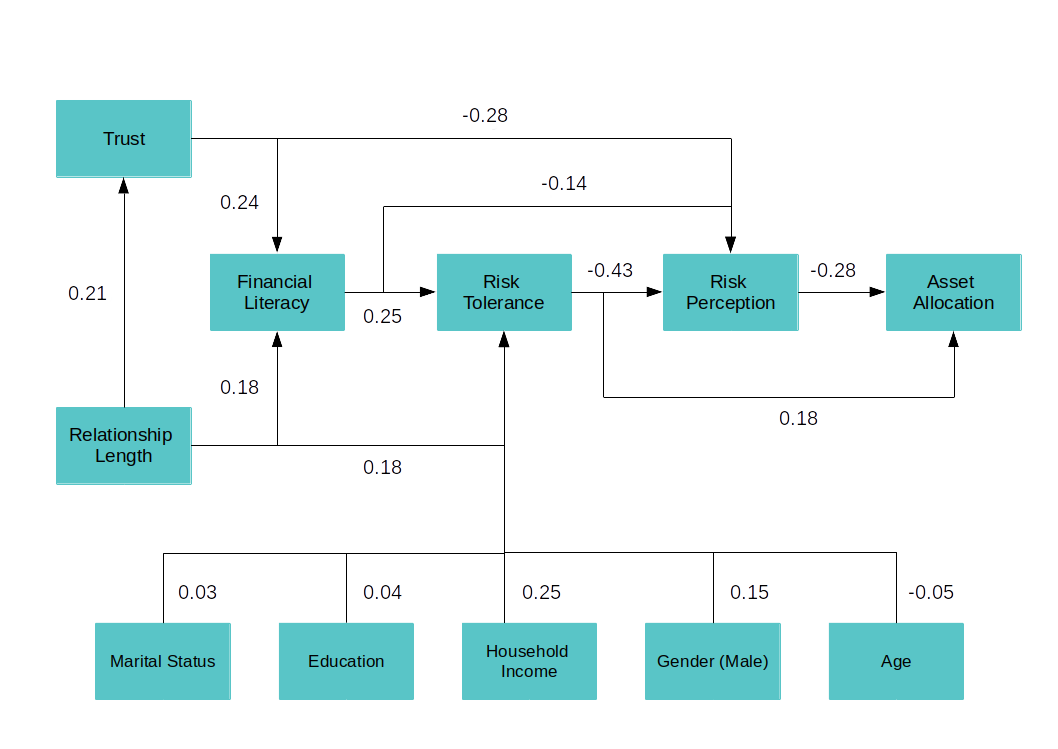

By adding behavioural variables to the risk profiling problem, Linh Nguyen et al. (2017) provide a simple asset allocation framework that uses both variables to profile the investor’s risk tolerance. Fig. 2. Demonstrates this framework’s inner relationships.

Prior studies have shown that when one party trust another, they form a positive relationship between trust and knowledge transfer/receipt at both the individual and organizational levels in different contexts.

H1: Client trust in the financial advice service is positively associated with client financial literacy.

H2: Client relationship length with the financial advice service is positively associated with client financial literacy.

On the other hand, longer-term relationships tend to be more trusting.

H3: Client relationship length with the financial advice service is positively associated with client trust in the service.

The length of time that a person has experienced risks has been found to affect the person’s risk tolerance.

H4: Client relationship length with the financial advice service is positively associated with client financial risk tolerance.

When an investor has a general financial literacy, they are usually more familiar with financial risks and often can tolerate them better.

H5: Client financial literacy is positively associated with client financial risk tolerance.

Olsend (2008) reviewed the literature on trust in the financial market and showed a game-changing finding that greater trust is related to lower perceived risk.

H6: Client trust in the financial advice service is negatively associated with client financial risk perception.

Olsen (1997) also showed that the investors who have more knowledge about a financial product or are more familiar with the product tend to perceive the product to be less risky.

H7: Client financial literacy is negatively associated with client financial risk perception.

Sitkin and Weingart (1995) explained that risk-averse people tend to overestimate negative outcomes, leading them to perceive more risk, while risk-seeking people are more likely to overestimate positive outcomes contributing to a lower perceived risk.

H8: Client financial risk tolerance is negatively associated with client financial risk perception.

Investors are likely to invest less in products they perceive riskier and vice versa. They also are likely to invest more in risky products when they can tolerate more risks.

H9: Client financial risk perception is negatively associated with the client's risky-asset allocation decision.

H10: Client financial risk tolerance is positively associated with the client’s risky-asset allocation decision.

Measurement

According to the above framework, now, we have a model for profiling individual investors’ total risk tolerance and providing the best asset allocation. In this step, we should focus on calculating and quantifying the variables for further steps. To make an accurate allocation, we need to quantify the trust, financial literacy, relationship length, risk tolerance, and risk perception.

Trust

To measure client trust in financial advisers, their advice, and the organizations, there are some questionnaires (Newton et al., 2012) that directly ask some questions about the level of investors’ trust. Responding to these questions often is not precise because we usually cannot quantize the trust into five different levels. We usually either trust someone or some organization or do not trust them. Weirdly, we position ourselves in the middle. However, this type of questionnaire is comprehensive enough to be employed for quantifying trust most of the time.

Relationship Length

This metric is measured by the total number of years a client had used the financial advisory services.

Financial Literacy

Linh Nguyen et al. (2017) make use of six items to measure self-assessed financial literacy in six specific financial and investment matters. These items, again, will be provided as a questionnaire.

Budgeting

Saving money

Managing debt

Investing money

Planning for the future

Saving money for retirement

Risk Tolerance

Risk tolerance evaluation has been studied extensively during the last decades, and there are myriad approaches for calculating risk tolerance. We can employ these methods or any other ones to quantify risk tolerance. Linh Nguyen et al. (2017) use eight items in their model to do the same job. Four of these items are from the ARC Linkage project’s survey (Newton et al., 2012), and four additional items, which are more relevant in explaining client asset allocation, are recommended by Guillemette et al. (2012). Their model can also be replaced by other models based on specific requirements.

Risk Perception

Linh Nguyen et al. (2017) provide 34 risk perception items to be used in their profiling questionnaire. These 34 items measure the following risk perception factors: Understanding, Worry, Loss related factors, Regulation, Attention, Trust in products, Performance predictability, Gain, and Volatility.

Providing new items or pruning some useless ones is the playing ground that needs innovations and creativity.

Final Framework

When we quantify all the items in the framework, it is time to find the edges’ weights to complete our calculations. Determining the weights will be done by empirical surveys from investors. Linh Nguyen et al. (2017) employed 364 well-diversified clients who had an accurate risk profile to complete their questionnaire and then used the data to tune their model and struct their framework with precise connection weights. The final framework is shown in Fig. 3. Note that all the weights’ values in this framework are based on the survey and would be incorrect in some ways.

Now, based on this framework, if advisors measure each factor faultlessly, the risk tolerance and the risk perception units will generate a score, respectively. Because they are in the opposite direction, they will form a final score that represents the final risk tolerance of an investor.

References

Guillemette, M. A., M. Finke, and J. Gilliam, 2012, Risk tolerance questions to best determine client portfolio allocation preferences, Journal of Financial Planning 25, 36–44.

Harold Evensky, DB Katz (2004). The Investment Think Tank: Theory, Strategy, And Practice For Advisers. Bloomberg press.

L. Nguyen, G. Gallery, C. Newton (2017). The joint influence of financial risk perception and risk tolerance on individual investment decision-making. Accounting and Finance.

Newton, C. J., S. Corones, G. Gallery, and N. Gallery, 2012, The Value of Financial Planning Advice – Process and Outcome Effects on Consumer Well-Being, ARC Project Time 1 Survey Questionnaire. (Queensland University of Technology, Brisbane, Australia).

Olsen, R. A., 2008, Trust as risk and the foundation of investment value, Journal of Socio-Economics 37, 2189–2200.

Olsen, R. A., 1997, Investment risk: The experts’ perspective, Financial Analysts Journal 53, 62–66.

Sitkin, S. B., and L. R. Weingart, 1995, Determinants of risky decision-making behaviour: a test of the mediating role of risk perceptions and propensity, Academy of Management Journal 38, 1573–1592.

Slovic, Paul (1992). Perception of risk: Reflections on the psychometric paradigm. In S. Krimsky & D. Golding (eds.), _Social Theories of Risk_. Praeger. pp. 117--152.